Hello and welcome to the session. This is Professor Farhad. In this session, we will look at Schedule M2 and M3 of Form 1120. We have already looked at Schedule M1. This topic is covered in a corporate income tax course, the CPA exam regulation section, as well as the enrolled agent exam. As always, I would like to remind my viewers to connect with me on a professional level. You can connect with me on LinkedIn. If you don't have a LinkedIn account, you should start one. It will allow you to network with other professionals and grow your connections. If you are a Facebook user, you can like my Facebook page. You should also consider subscribing to my YouTube channel and liking my videos. If you like them, please share them and put them in playlists. Thank you very much for your support. I also have a Twitter account and a website. On my website, I always try to offer CPA deals. Currently, I have a CPA deal from Becker. They are offering unlimited access, which is unprecedented. If you go through my website, you can save $495 on the Becker unlimited access. Take advantage of this offer. Now let's talk about Schedule M2. So, what is the big idea behind Schedule M2? Well, if you read carefully, you will see that Schedule M2 is a statement of retained earnings. Do you remember the statement of retained earnings? If not, it is important to become familiar with it and learn how to compute the changes in retained earnings. Let's go over this quickly. We take beginning retained earnings and add net income, or subtract net loss if applicable. Then, we subtract dividends to get the ending retained earnings. This is a simple but powerful formula that you should have learned in accounting...

Award-winning PDF software

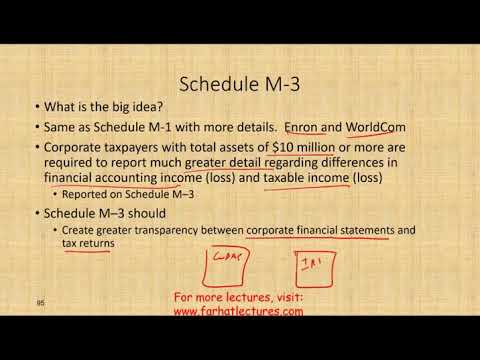

1120 (Schedule M-3) Form: What You Should Know

Calculation of Consolidated Reportable Items for Tax Year 2025 — Income Tax Return — IRS Schedule M is required by the IRS to calculate tax income for an entity that has a book income for 2025 that is equal or greater Calculation and Reporting Requirements for Corporations — IRS The financial position of a corporation during a tax year is usually determined using its balance sheet, cash, cash equivalents, debt, accrued pension and other plan benefit obligations, and other information recorded in its financial statements. The term balance sheet includes the statement of income and its income statement. The balance sheet is considered a statement of the corporation's financial condition; it is intended to contain such information regarding the corporation's financial position at various times throughout the accounting period as are necessary in order to establish the corporation's financial condition. The statement of financial position in a balance sheet is determined using the statement of financial condition. A corporation's balance sheet and statement of income are separate financial reports for tax purposes. When the combined balance sheet and its statement of income contain the same information, the combined statement is the balance sheet. If the balance sheet and statement of income contain different information, they are considered statements of financial condition and income. Statement of Balance Sheet. Table 1—Statement of Income Table 2—Statement of Financial Condition and Balance Sheet 1. Income before income taxes and after deducting all items of income or deduction from all sources and before depreciation, amortization, depletion, or depletion allowances to the extent the amounts are deductible for Federal income tax purposes. (See ¶2.47.) 2. Income taxes paid on total income before deductions for Federal income tax purposes, plus all net income from continued operations attributable to continued operations for any year, plus tax on net income for years after the year in which taxable income for that year is the same as taxable income in the previous year, and all income in excess of amounts included under item 1 in the statement of cash flows as of the end of the current taxable year, Schedule M (Form 1120) — Schedule M is required if the total assets of the entity equals 50,000,000 or more. The calculation is: Calculation for Consolidated Reportable Items Calculation of book income. Table 1—Statement of Income Schedule M-1 (Rev.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1120 (Schedule M-3), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1120 (Schedule M-3) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1120 (Schedule M-3) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1120 (Schedule M-3) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 1120 (Schedule M-3)