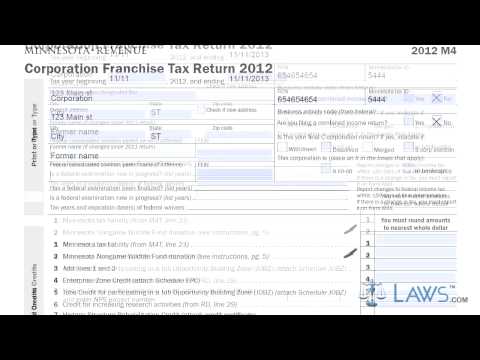

Laws.com legal forms guide form M4 Corporation Franchise Tax Return is used by corporations doing business in the state of Minnesota to file their franchise tax owed to the state. This document can be found on the website of the Minnesota Department of Revenue. To complete the form, follow these steps: 1. At the top of the form, provide the beginning and ending dates of your tax year. 2. Provide the name of your corporation or its designated filer, along with your current address. If you previously filed under a different name, include your former name. If your corporation has a federal consolidated common parent name different from yours, provide that information as well, along with the parent company's federal employer identification number. 3. Provide your federal employer identification number and state tax identification number. If you are filing a combined income return, indicate this by checking the appropriate . If you are filing a final return due to being withdrawn, dissolved, merged, or taking on S corporation status, indicate the reason. 4. If a federal examination has been finalized or is in progress, provide the applicable years and the tax years' expiration dates for any federal waivers that have been issued. 5. Skip to Form M41 on the second page and follow the instructions to determine your Minnesota apportionable income. Transfer this amount to line one of Form M40 on the last page. 6. Follow the instructions for Form M40 to determine your Minnesota tax liability. Transfer this amount to the first line of the first page. 7. Complete lines two through thirteen to determine the amount due. 8. If you are filing late and must pay penalties and interest, complete lines fourteen through seventeen. 9. If you have overpaid and are due a refund, complete lines eighteen through twenty. 10. If you are owed a refund, you may...

Award-winning PDF software

Video instructions and help with filling out and completing Will Form 1120 Schedule M 3 Taxpayer