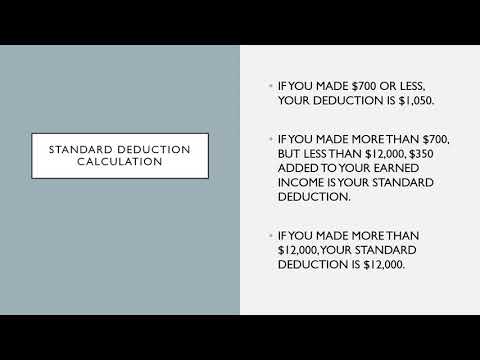

This video will teach you how to repair a 2018 tax return. If your parents can claim you as a dependent, the scenario of this video is that you had one job with no other sources of income. The form that you would use is form 1040 because in the year 2018 there is no longer 1040ez or 1040a. Begin preparation by writing your name, address, and social security number at the top of the form. Also, under filing status, check the 'Single' at the bottom of the form. You're gonna want to sign and date it and put your occupation down. The next step is to prepare page 2 of the form 1040. You're gonna pull your W-2 and look at the one which says 'Wages, tips, and other compensation'. In our example, the wage that was earned was $800. Put that in line 1 of the form 1040 2018. Hold it down to line 6 which is $800 because this is your only source of income. You have no adjustments to income, so on line 7, again put $800. On line 8, you have to calculate your standard deduction which will be done on the next slide. This is the standard deduction worksheet that the IRS provides to calculate your standard deduction. It can be found in the instructions. I have summarized the IRS's standard deduction worksheet with the following: To calculate your standard deduction, if you made less than $700, your deduction is $1050. In our example, the person made $800, so it is more than $700. So, to that, you will add $350 because if you made more than $700 or less than $12,000, you add $350 to whatever you made during the year. If you made more than $12,000, your standard deduction is $12,000. So,...

Award-winning PDF software

Video instructions and help with filling out and completing Will Form 1120 Schedule M 3 Deduction