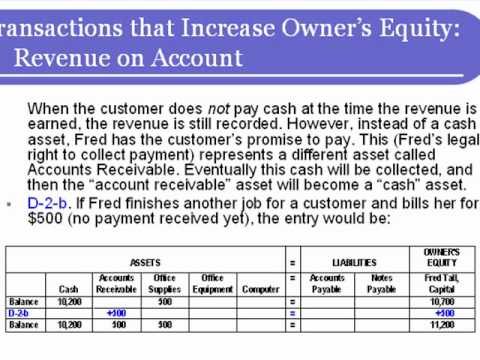

Hello again. This video continues on from the first video presentation in the module. We explained in the previous video that accountants keep track of assets, liabilities, and owner's equity. We mentioned that a way to do that would be to use a sheet of notebook paper. At the top of the page, we would write assets, liabilities, and owner's equity. As transactions occur and change the balances in the asset, liabilities, and equity accounts, we can record those changes in our notebook. Later, when anyone wants to know the assets and equities of the business, we can refer back to our notebook for the information. Now, in our notebook, we have divided the page into two sides. We have a heading called assets and separate columns for the individual assets that we want to report at the end of the accounting period. The columns include cash, accounts receivable, office supplies, office equipment, and the computer. We also have two liability accounts: accounts payable and notes payable. We will explain the difference between them later. The owner's equity is referred to as the owner's capital in the business. Each of these columns represents an account. Let's begin recording business transactions using this form. The first business transaction given in the module example is that our owner contributes assets to the business. The owner contributes $10,000 of cash and $500 of supplies. To record this, we need to increase the cash account by $10,000 and the office supplies account by $500. Since the owner has contributed these assets, we will also need to increase the owner's equity by $10,500. After doing this, we now have balances in our business accounts. Prior to this transaction, there were no assets in the business. If we total up our account balances, we see that we...

Award-winning PDF software

Video instructions and help with filling out and completing Who Form 1120 Schedule M 3 Indirectly