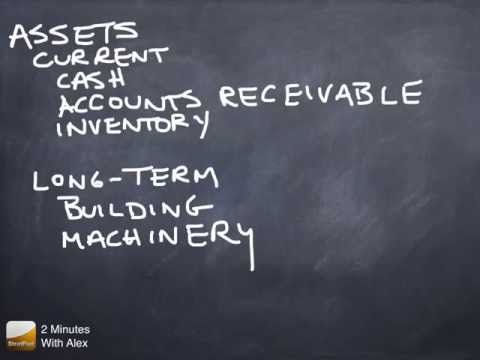

So let's take a look at the assets section of the balance sheet. The asset section is commonly divided into two pieces: current assets and long-term assets. Current assets are assets that can be turned into cash within a year and a short period of time. They include cash, accounts receivable (AR), which is the amount of money that your customers owe you, and inventory. On the other hand, long-term assets include things like buildings and machinery. Now, let's put some numbers into this so you can see how the assets section totals. Let's say we have a total of $1000 in cash. Our customers owe us a total of $5,000 in accounts receivable. Additionally, we have $10,000 worth of inventory sitting on our shelves. To calculate the subtotal for current assets, we add the values: $1,000 (cash) + $5,000 (AR) + $10,000 (inventory) = $16,000 worth of current assets. Moving on to long-term assets, our building is worth $150,000 and we have machinery worth another $25,000. This gives us a subtotal of $175,000 for long-term assets. Finally, we create the total assets by adding the subtotal of current assets ($16,000) to the subtotal of long-term assets ($175,000). The total assets, therefore, amount to $191,000. At the bottom of our financial statement, we double underline and state that our assets are $191,000. Next up, we'll move on to the liabilities and owner's equity.

Award-winning PDF software

Video instructions and help with filling out and completing Where Form 1120 Schedule M 3 Totals