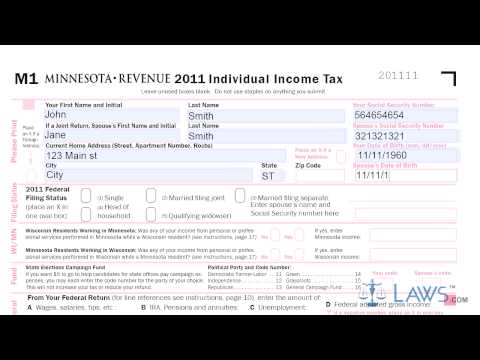

Laws.com legal forms guide form M one is a printable form for individuals owing income tax to the state of Minnesota. This form can be found on the website of the Minnesota Department of Revenue. Step 1: The top part of the form requires you to enter your identifying information. This includes your first name, middle initial, and last name. Additionally, you need to provide your social security number and date of birth. Step 2: If you file your taxes jointly with a spouse, include their first name, middle initial, last name, birth date, and social security number in the designated fields. Step 3: Provide your complete current street address, including the city, state, and zip code. Step 4: Indicate your federal filing status by placing an 'X' next to the applicable statement. Step 5: The section below is only for Minnesota residents who earned income in Wisconsin and vice-versa. Step 6: Note if you wish to donate five dollars to the state elections campaign fund. Step 7: Add your federal adjusted gross income as recorded on your federal income tax return. Step 8: Enter your federal taxable income on line one. This can be found on line 43 of your federal form 1040, line 27 of form 1040a, or line 6 of form 1040ez. Step 9: Line two is for your state income or sales tax additions. Those who filed an itemized deduction on their federal return must complete a worksheet provided in the instructions booklet on page ten. Step 10: Enter all other additions on line three. Step 11: Add lines one through three and enter the sum on line four. Step 12: Complete the rest of the form as instructed to determine your tax before credits are applied. After completing the above steps, continue to the second...

Award-winning PDF software

Video instructions and help with filling out and completing When Form 1120 Schedule M 3 Historical