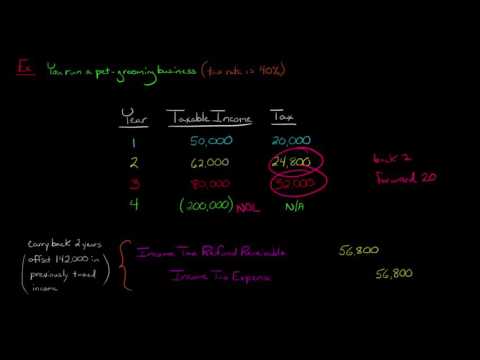

In this video, we're going to discuss how to record a net operating loss in financial accounting. So, when a firm loses money, the IRS will allow the firm to take that loss and use it to offset past or future taxable income. For example, if the firm had lost money in either of the prior two years, it can carry back the loss to get a refund of the tax that it paid. Alternatively, the firm can also carry forward the tax loss to offset any profits in the future. This means that if the firm lost $100,000 this year but makes $50,000 next year, it will be able to offset that loss and eliminate the tax it would otherwise have to pay in the future. Now, let's use a pet grooming business as an example. Imagine you run a highly successful pet grooming business that takes care of cats, dogs, and even tarantulas. The tax rate your firm faces is 40%. Here's the financial situation for the last four years: - Year 1: $50,000 profit - Year 2: $62,000 profit - Year 3: $80,000 profit - Year 4: A catastrophe occurred, and you lost $200,000. Now, you have a net operating loss (NOL), which means you don't have to pay any tax in Year 4 since you lost money. However, you can carry back the loss to the previous two years or carry it forward up to 20 years. Let's see how this works. First, you can offset the previous year's taxable income and the year before that. But you cannot go back further than that. In this case, you can offset the $80,000 and the $62,000, which adds up to $142,000 in previously taxed income. Since your tax rate was 40%, you would get a refund of the tax you paid on that...

Award-winning PDF software

Video instructions and help with filling out and completing What Form 1120 Schedule M 3 Carryovers