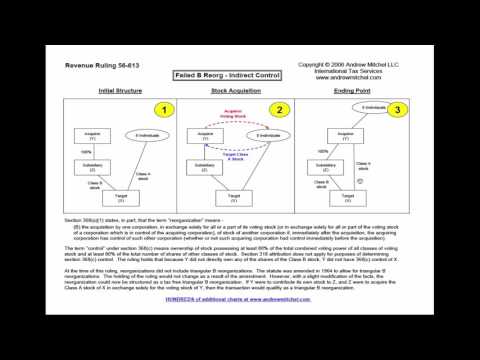

In revenue ruling 56 613, an acquiring corp had a wholly owned subsidiary. The subsidiary owned all of the class b shares of target corporation. The class a shares of the target corporation were owned by eight individuals. The acquiring corporation issued some of its voting stock to the eight individuals in exchange for the target class a stock. After the acquisition, the acquiring corporation directly owned the class a shares and indirectly through attribution owned the class b shares through its subsidiary. To qualify as a B reorganization, the acquiring company must own what is known as section 368 C control of the target corporation. Section 368 C control means at least eighty percent of the total combined voting power of all classes of voting stock and at least eighty percent of the number of shares of other classes of stock. Here, the acquiring Corp directly owns the class a shares and through attribution owns the class b shares. However, the attribution rules do not apply for purposes of determining section 368 C control. Therefore, the acquiring corporation does not have section 360 AC control of the target corporation, and the transaction does not qualify as a B reorganization.

Award-winning PDF software

Video instructions and help with filling out and completing How Form 1120 Schedule M 3 Historical