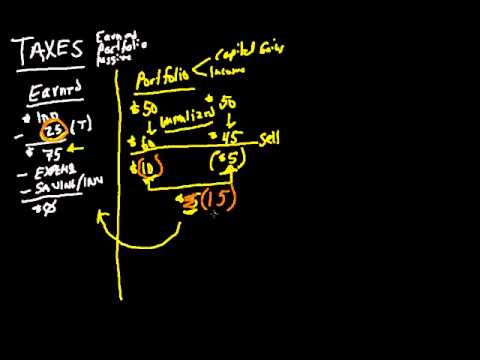

Well hello everyone, welcome back. This video is about the tax differences between the various forms of income. Just as a reminder, at this point in the video series, we've covered and talked about earned income, portfolio income, and passive income. These are the three types of income, and any kind of income falls into one of these categories. This video aims to describe the main differences between the three forms of income when it comes to taxes. It's important to understand why earned income is considered the worst way to make money, and why portfolio and passive income offer tax planning and advantages that earned income doesn't. Let's start with a couple of basic examples. For earned income, if you make $100 from an employer, before you get paid, the employer withholds taxes from your paycheck. Let's say you're in a 25% tax bracket, so $25 is withheld. Before you even get your money, you're down $25, and all you get is $75 as your take-home pay. From there, you can pay your expenses and invest. Now let's focus on portfolio income. This type of income is associated with investments such as stocks, bonds, and mutual funds. Portfolio income can come in the form of capital gains or income from dividends and interest. For example, if you purchase a share of Coca Cola for $50 and a share of Pepsi for $50, and hold onto them for two years, you may experience capital gains or losses when you sell them. Let's say the Coca Cola share increases in value to $60, while the Pepsi share decreases to $45. Up until this point, there have been no tax consequences. The gains or losses are unrealized because you haven't sold the stocks. However, when you sell the shares, it triggers a...

Award-winning PDF software

Video instructions and help with filling out and completing How Form 1120 Schedule M 3 Disclosed