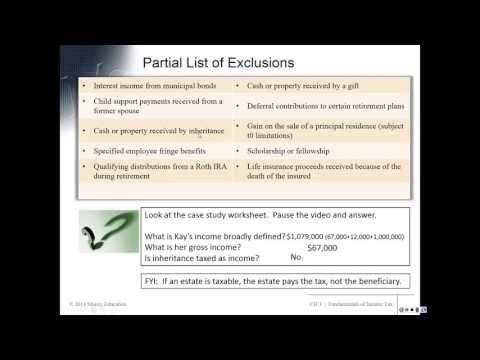

Okay, fundamentals of income tax. Basically, this is the fundamentals you need to know. Everything in this chapter, we're going to split it up into two parts. So here is part one. If you want to pause and read these topics, please do so. We are going to introduce you to taxation by means of a case study. In the module, there are handouts about our client, Que Alvarez, and questions for you to answer, as well as tax forms and tax information. So here is Kay. She comes to us for the first time for a consultation in early April of 2017, and she hasn't filed her 2016 income tax return, which is going to be due on April 15th. So she's 30 with one child, Aubry, who is 8. She knows she will file as head of household, claiming Aubry as a dependent. Here's her social security number and address. She gives you her W-2, and you see that her taxable income was $67,000, and income tax withholding was $5,000. In addition, she tells you she received $12,000 of child support from her ex-husband, and she inherited a million dollars from an uncle this year. She gives you additional information. She has a 1098 that shows her student loan interest paid. She owns a home. She paid $2,000 of mortgage interest and $7,000 of principal payments on that mortgage. She paid property taxes of $3,000 and charitable contributions in 2016 of $1,000. You continue discussing her situation with her. She has $3,000 of deductible moving expenses. This is something that you found by questioning her. She had no idea that her moving expenses might be deductible. You also find out that she will be eligible for the child tax credit amount of $1,000. And next, you're going to...

Award-winning PDF software

Video instructions and help with filling out and completing How Form 1120 Schedule M 3 Deferred