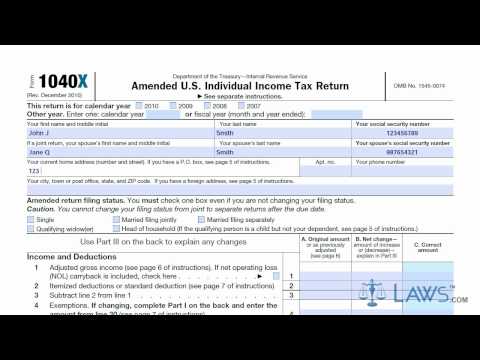

Laws.com's legal forms guide, Form 1040X, is a United States Internal Revenue Service tax form used to amend an individual's tax return. It is specifically designed for all versions of the 1040. To amend a tax return, you must file the 1040X within three years of the original tax return you are attempting to change. You can obtain Form 1040X from the IRS website or a local tax office. The form must be filed by the taxpayer anytime before three years have passed for the amended tax return. Form 1040X is similar to Form 1040, but it includes additional fields to indicate changes. To fill out form 1040X, start by entering your personal information in the top section. This includes your name, social security number, and contact information. If you are filing a joint return, you must also include your spouse's name and social security number. Indicate your filing status below your contact information, even if you are not changing it. Next, enter all income and deductions as they appeared on your original 1040 form. If there are any changes, enter the correct amounts in the appropriate fields. Line by line, copy all information from your original tax return. For items that you have amended, make sure to include the original amount, the changed amount, and the correct amount. Once you have completed lines one through 31, check the appropriate in part two. In part three, write an explanation of your amended 1040. If you have any supporting documents for the amendment, attach them to Form 1040X. Make sure to provide a clear explanation as the amendment needs to be approved by the IRS. Finally, sign and certify the form in the designated fields. If the form was prepared on behalf of someone else, provide the preparer information. Keep a copy of the completed...

Award-winning PDF software

Video instructions and help with filling out and completing How Form 1120 Schedule M 3 Columns