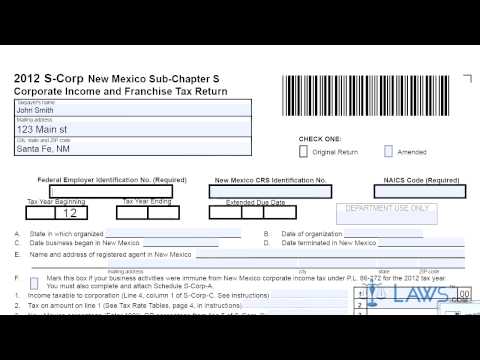

Law.com Legal Forms Guide helps with filing S Corporation income and franchise tax returns for S Corporations operating in New Mexico. - The form can be obtained from the website of the Taxation and Revenue Department of the State of New Mexico. - To begin, fill in your name, mailing address, and indicate if you are filing an original or amended return. - Enter your federal identification number, NAICS code, and your state's ERS ID number (if issued), along with the beginning and ending dates of the tax year you are filing for. If you have an extended due date, include it. - Provide the state in which your corporation was organized, the date you began doing business in New Mexico, and the date on which you ceased operating (if applicable). Also, provide the name and address of your New Mexico registered agent. - S Corporations with federal taxable income should skip to Schedule S Corp on the third page. Complete this portion using your federal return 1120s Schedule D and transfer the New Mexico taxable percentage of your income from line 5 to line 3 on the first page. - Complete lines 1 to 23 as instructed to determine your tax owed to New Mexico. - Schedule S Corp Part 1 computes income taxable to owners. - Schedule S Corp Part A is for S Corporations operating in multiple states to determine their New Mexico apportionment factor. - Schedule S Corp Part B calculates allocated non-business income taxable to owners. - For more information and resources, visit the Law.com website.

Award-winning PDF software

Video instructions and help with filling out and completing Form 1120 Schedule M 3 Misc