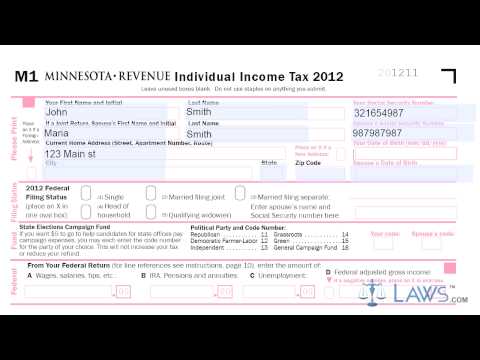

Laws.com legal forms guide for ma'am. One individual income tax. If you owe income tax to the state of Minnesota, you should file and failure liability using a form M1. This form is found on the website maintained by the Minnesota Department of Revenue. Step 1: Enter your name, social security number, and date of birth at the top of the form. Provide the same information for your spouse if filing jointly. Step 2: Give your current address, city, state, and zip code. Step 3: Indicate your filing status where indicated. Step 4: Wisconsin residents who earned income in Minnesota and Minnesota residents who earned money in Wisconsin should note this where indicated. Step 5: Lines 1 through 8 provide instructions for computing your Minnesota taxable income. Step 6: Enter your tax on line 9. The rate for your taxable income can be found in the instructions booklet for Form M1. Step 7: Complete lines 10 through 14 to determine your tax prior to the application of credits. Step 8: Lines 16 through 19 provide instructions for the application of non-refundable credits. Step 9: Lines 20 through 22 adjust your tax owed based on these credits. Step 10: Lines 23 through 29 provide instructions for the documentation of tax payments already made. Step 11: Lines 30 through 35 provide the final calculations necessary to determine the size of the tax payments to be made or the refund you are owed. Step 12: If you are owed a refund, you may choose to provide your account and routing number in order to receive it via a direct deposit. Indicate with a check mark whether this is a savings or checking account. Step 13: Sign and date the form and provide a daytime phone number. If filing jointly with a spouse, they...

Award-winning PDF software

Video instructions and help with filling out and completing Form 1120 Schedule M 3 Filers