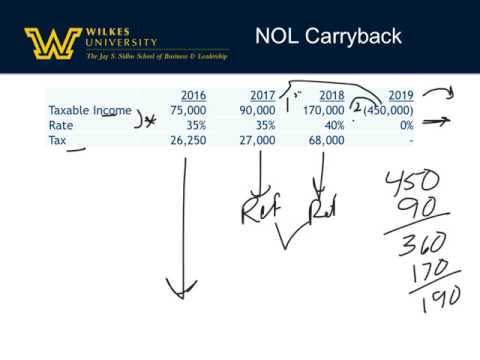

Here are some income tax examples for NOL carry back and carry forward. We have information about a company's income in 2016, 2017, and 2018. We are given the amount of taxable income and the tax rates along with the tax. To calculate the tax, we can multiply the taxable income by the tax rate. In 2019, there is no tax, so we don't need to worry about that for calculations. However, it's important to note that we can carry back our loss. We must carry back two years, so in 2019, we carry back to 2017. 2016 serves as a reference point and does not change. First, we will take the $90,000 loss and the 35 percent tax rate to calculate the $27,000 that was paid in taxes. We can then request a refund. With a $450,000 loss and using only $90,000, there is still $360,000 left. Next, we will carry back the remaining $360,000 loss to the year 2018. We will receive a $68,000 refund, bringing our total to $170,000. Subtracting this from the remaining loss, we have $190,000 left. We can carry this forward for 20 years. It's important to consider whether the company will have income in the next 20 years. If not, it may not survive. Additionally, there needs to be a time limit for carrying forward losses. We can develop a table to keep track of all the information. It may include redundant information, but it allows us to double-check our work. Starting with taxable income and including the year 2016, we know there will be no refund. We calculate a taxable income of $75,000, which results in a tax of $26,250. Moving to 2017, we have a $90,000 income minus the $90,000 carried back, resulting in a new taxable income of zero. With a tax rate of 35...

Award-winning PDF software

Video instructions and help with filling out and completing Form 1120 Schedule M 3 Casualty