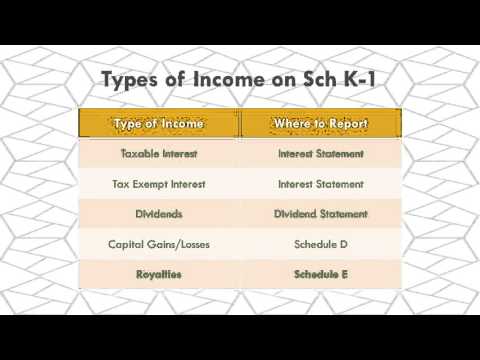

In this lesson, we're going to discuss Schedule K-1 and the income reported on Schedule K-1. After completing this lesson, you should be able to identify Schedule K-1 income that is within the scope of Vitae. A Schedule K-1 is used to report the taxpayer's share of income, distributions, deductions, and credits from partnerships, S corporations, and some estates and trusts. S corporations are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. Shareholders of S corporations report the flow-through of income and losses on their personal tax return and are assessed tax at their individual income tax rates. This information may not be super important for you to know, but it explains why taxpayers may receive Schedule K-1 forms. There are different types of income that can be reported on a Schedule K-1, but the ones within our scope are interest, dividends, capital gains and losses, and royalty income. Schedule K-1 forms can come in a variety of types, including Form 1065, Form 1120S, and Form 1041. They all look very similar and will say Schedule K-1. If the taxpayer receives one of these forms and brings it into the site, we can report it on the tax return as long as it falls into one of the four types of income mentioned earlier. Taxable interests reported on the Schedule K-1 will be reported on the interest statement, as well as tax-exempt interest. Dividends will be reported as dividends from Form 1099-DIV. Any capital gains or losses reported on the Schedule K-1 will be reported on Schedule D, as they would be for stocks and bonds sales. The only new item that needs to be reported on the tax return is royalty income, which will be reported on Schedule...

Award-winning PDF software

Video instructions and help with filling out and completing Form 1120 Schedule M 3 Amend