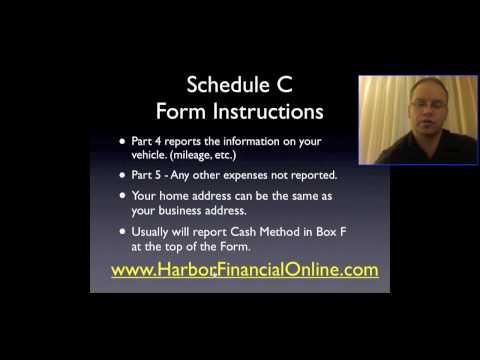

Welcome back to another video for Harbor Financial Online.com. Today, I'm going to be talking about the Schedule C form, the instructions, and how to file this form. This form gets attached to your regular 1040 and is not a separate tax filing, so that's where it gets confusing. I want to try to help you guys out with the filing requirements on this. So, what we're gonna do is, I'm going to cover the areas of the Schedule C in these PowerPoint slides, and then we'll go right to the Schedule C towards the end. So, I'm going to give you a background of the Schedule C real quick, and the different sections. Part 1 of the Schedule C is the total of your gross receipts. This will be the total you receive from 1099-MISC miscellaneous forms. Okay, what you're gonna do is total up all these 1099s and put it into Part 1 of the Schedule C. Now, you still have to enter income that you didn't receive 1099s for. If you got paid cash, or even if you got paid check, a lot of these places still won't issue the 1099 just because they're not keeping up to date on their tax requirements. But you still have to report the income. In Line 2 of the Schedule C, you're gonna report any returns. Now, these are items that you've sold but they are returned. Okay, 'cause that's gonna offset your income, so you want to make sure you're reporting any returns. Your cost of goods sold will be reported on Line 4. This is your inventory, and in the couple slides ahead, we're going to cover that cost of goods a little bit more. Your gross income, the total of your gross income for your business, will...

Award-winning PDF software

Video instructions and help with filling out and completing Fill Form 1120 Schedule M 3 Taxpayer