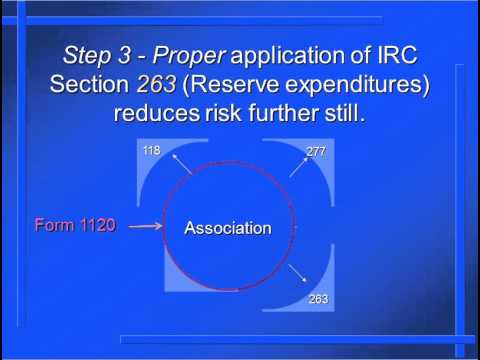

Welcome to our presentation on homeowners association taxation. This presentation focuses on reducing the inherent risks of Form 1120. In our last presentation, you've already seen a graphical representation of the risks. Those red areas are the tax exposure that exists inherently on Form 1120. Now, let's show you how to reduce that risk. Because you need to properly apply tax law, you really need to be conservative and consistent in your tax approach. You also need to follow proper procedures in documenting your actions. Rather than stretching tax law and creating tax risk, you can file Form 1120-H, but that's the easy way out and you'll pay more taxes. Alternatively, you can reshape your association to fit within the existing Form 1120 tax law. To do this, you need to properly apply Step 1 of Internal Revenue Code Section 118, which applies to reserve assessments. This is how you accomplish your first step of reducing tax risk. There are about six different steps you've got to follow to properly apply Code Section 118. Step 2 involves the proper application of Internal Revenue Code Section 277, which relates to membership income and deduction. This will further reduce the risk. Step 3 is about the proper application of Internal Revenue Code Section 263, related to reserve expenditures. Under Code Section 263, you may not deduct capital expenditures. Your reserve expenditures, by definition, almost always qualify as capital expenditures and therefore cannot be deducted on Form 1120. Finally, step 4 is the proper application of Revenue Ruling 70-604, which substantially reduces risk. We have two more presentations that deal with this important issue. Revenue Ruling 70-604 can be misunderstood and unfortunately misapplied. It takes a lot more effort and a much higher level of knowledge to reshape your association, but this is important...

Award-winning PDF software

Video instructions and help with filling out and completing Fill Form 1120 Schedule M 3 Publicly