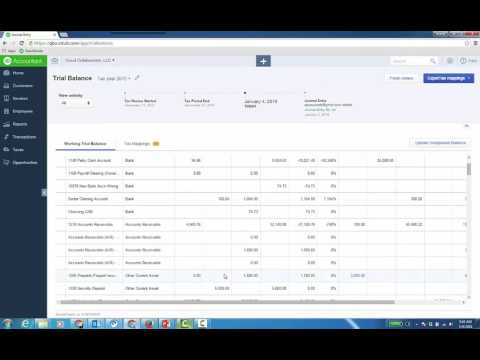

When you're in the client dashboard of QuickBooks Online accounting, as I am right now, you'll see this tax column. We have updated the books to tax feature and just calling it trial balance now, so you no longer need to integrate within two attacks online to get benefit out of this key trial balance tool. Now, you see I've started some reviews, and that's basically what you're doing. I reviewed 14 and now 15, of course. So, I'm in January 2016, so it's very timely this video. Let's go into a client file and work on the trial balance. Now, I can launch it from here to get in there, or I can just go into the client file, into the drop down, or click on the little QB icon in the status column. As you go into a QBO client file from QA, as you do, and under the accountant tool briefcase icon, which is in between QB accountant and the name of your client file, you'll see accountant tools. The very first one is the trial balance, so we'll go ahead and click on that. And as you can see, the tax year is 2015. Of course, I could review 14 FL one to two as well. I'm gonna leave it at 15, and I started a review on the 21st of December. Let's go over to some of the columns. So, you have two tabs: working trial balance, then tax mappings. And the working trial balance, this is going to be the trial balance, all your accounts in the trial balance that have had a balance in either 14 or 15. So, you can see all my accounts going down. Let's go back to the top, then the type, and then this will be my 2014 ending balance. We lock these columns,...

Award-winning PDF software

Video instructions and help with filling out and completing Fill Form 1120 Schedule M 3 Ledger