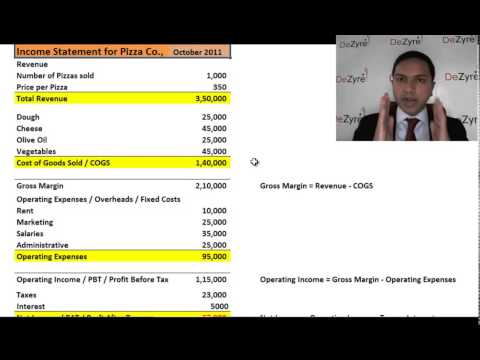

I welcome you back. I hope you're doing well so far in your sessions, especially the last session. By now, you will have a very good understanding of the income statement, the different ratios in an income statement, and how to analyze it to make important decisions for a company. Now, the income statement segment is done. That's it. Now, there is another financial statement that goes hand-in-hand with an income statement. Almost every time there is a change to an income statement, there is also a change happening in another financial statement. That statement is the focus of today's session, and that statement is called the balance sheet. The balance sheet helps to give you an intuitive feel of your financial situation. Let's go back to our example of personal expenses that we discussed in the first session. I mentioned that it's a good habit to keep your own personal statement of accounts, where you write down your monthly salary and expenses. But is that all? Does that give you or someone else a complete financial picture about yourself? Take a look at the statement and think about it. Is there anything else in your financial universe other than your income? The answer is yes. There are a few other things to consider. For example, your salary is 1 lakh, and you've been spending all this money. You managed to save 28,000 rupees. But where is that money going? It is probably getting added to your bank balance. You may also have investments in the stock market, debts to pay off, a house, a car, and other assets and liabilities. An income statement alone does not give a complete financial picture. You need a balance sheet to include all these other aspects of your financial situation. Now, let's look at what a...

Award-winning PDF software

Video instructions and help with filling out and completing Fill Form 1120 Schedule M 3 Accounting