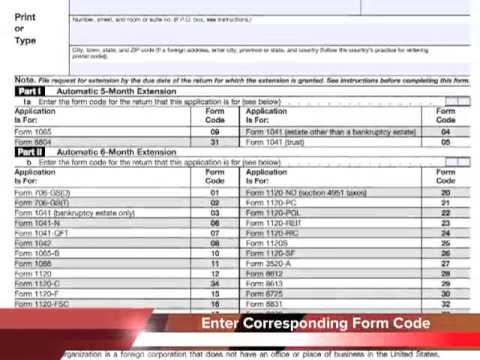

Divide this text into sentences and correct mistakes: 1. What 1120s is the US income tax return for an S-corporation. 2. A request for an automatic six-month extension for filing the tax return may be made by filing Form 7000 or with the Internal Revenue Service before the return's original deadlines. 3. The Form 7000 for extension may be filed electronically, depending on the details of the entity. 4. A paper filing may be made to the Internal Revenue Service centers in Ogden, Utah, or Cincinnati, Ohio. 5. The appropriate form code must be entered in part two of Form 7004 to confirm the type of return you are extending. 6. Filing Form 7004 does not extend the time of payment of tax due, and late payment penalties could apply if timely payment is not made. 7. Direct links to the IRS to access both Form 7004 and its instructions can be found immediately below this video. 8. Be sure to subscribe to our channel to receive continuing updates on important tax tips and other business topics. 9. That's Form 7004, and that's your one-minute business brief.

Award-winning PDF software

Video instructions and help with filling out and completing Fill Form 1120 Schedule M 3 Accordance