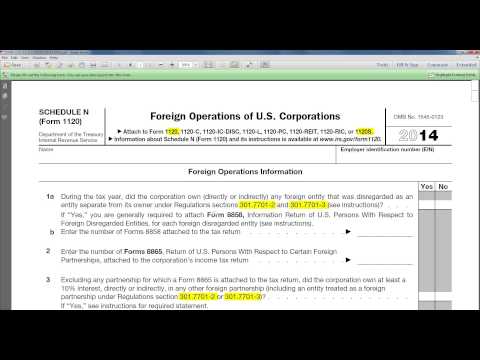

Is a checklist a checklist? Or is it a form of forms that you need to file? And is it attached to the forearm 1120? You will see that right here, or 1120s, and also any other 1120. But for most of our clients, these are the forms that we work with. It's an interesting forearm. Sometimes it's forgotten, which can cause a problem with the IRS. But what industry is this specifically related to? These regulations are important for international tax planning. Both of these regulations together are the law undecided when a foreign entity is a corporation, disregarded, partnership, or foreign trust. Making a mistake here will cause a lot of problems. The law is not as clear as we would like, but it is clear in the first regulation 31.77-1. This is a regulation that lists foreign corporations that the IRS has explored and decided to have all the corporate characteristics under our domestic law. The check the election does not change their status. So, much like if you would form a California corporation, you can't file check the election to make it a disregarded entity. Regulation 31.77-1 talks about the other type of foreign entities, such as foreign companies, foreign corporations, and foreign LLCs. There are also foundations in Panama, and Kingston has its own type of corporations. You need to go through all these classifications and make a determination. By far, the most difficult aspect is anything that is not classified as a corporation. Our concept, once again, is quite often called a "company" under the laws of places like the UK and most of Europe. Those entities will be per se corporations if you do nothing, or you can use the check the election. For other kinds of entities, there's a lot of uncertainty...

Award-winning PDF software

Video instructions and help with filling out and completing Can Form 1120 Schedule M 3 Traded