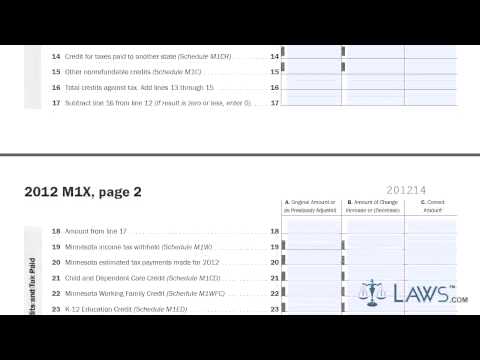

Laws calm legal forms guide form m1x amended Minnesota income tax. Those who file a state income tax return in Minnesota, which must later be amended, do so using a form m1x. This document is found on the website of the Minnesota Department of Revenue. Step 1: At the top of the page, give your name, social security number, and date of birth. The same information should be provided for your spouse if filing jointly. Step 2: Give your current home address, including the city, state, and zip code. Step 3: Indicate with a checkmark your filing status claimed on your original return and on this amended return. Step 4: Indicate, by placing an X next to the applicable statement, if you are filing an amended return due to a federal audit or adjustment, a net operating loss carried back from a tax year, or a claim due to a pending court case or other. For the latter two reasons, provide an explanation at the bottom of the next page where indicated. Step 5: Four lines (1 through 24) and three columns must be filled in. In column A, enter the originally reported or last amended amount. In column B, enter the amount of the positive or negative change. In column C, enter the amended amount. Step 6: Calculate your state taxable income on lines 1 through 5 as instructed. Step 7: Lines 6 through 17 provide instructions for calculating your tax liability. Note that line 9 is only for part-year residents and non-residents. Step 8: Document tax credits and payments already made on lines 18 through 26 as instructed. Step 9: In lines 27 through 35, the final set of calculations will determine whether you owe tax or whether you are owed a refund. If owed a refund, you...

Award-winning PDF software

Video instructions and help with filling out and completing Can Form 1120 Schedule M 3 Supporting