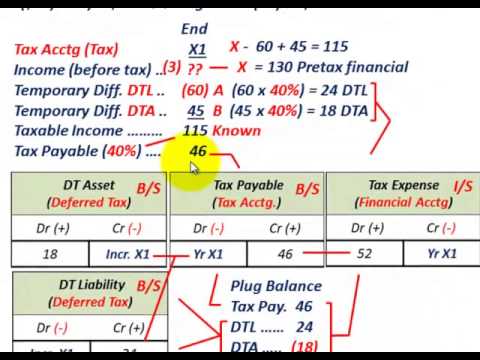

We're going to be going through an example where we can look at the reconciliation of pre-tax financial income and taxable income. For this example, we know our taxable income but need to determine our pre-tax or financial income. There are no permanent differences, but there are temporary differences that result in deferred tax assets and deferred tax liabilities. We will also calculate the tax expense, tax payable, and any deferred tax assets or deferred tax liabilities for the period. Let's look at the example. Our goal is to determine our pre-tax income, which will be equal to our tax accounting purposes and our pre-tax financial income. We can determine this based on the changes in temporary differences for the period. We have two temporary differences, one for a deferred tax liability and one for a deferred tax asset. We also know our taxable income, which allows us to determine our tax payable. To reconcile our taxable income with our pre-tax income or financial income, we follow this procedure. In this example, we have a deferred tax liability of $60,000 at the beginning of the period. To determine the related temporary difference for this liability, we divide $60,000 by the tax rate of 40%. This gives us a temporary difference of $150,000. The temporary difference is calculated by multiplying the difference by the tax rate. So, $150,000 divided by 40% equals $60,000, which is the deferred tax liability. At the end of the year, we determine the temporary difference for the deferred tax liability to be $110,000. Comparing the beginning balance of $150,000 with the ending balance of $110,000, we see an increase of $60,000. This increase represents a future taxable amount resulting from the temporary difference. Now let's look at how we deal with deferred tax assets. At the beginning of the year,...

Award-winning PDF software

Video instructions and help with filling out and completing Can Form 1120 Schedule M 3 Statutory