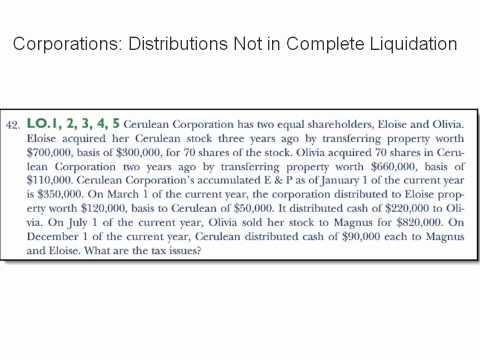

Let's explore this question that you see on the screen. Cerulean Corporation has two equal shareholders, A and E. A and E acquired their Cerulean stock three years ago by transferring property worth $700,000 with a basis of $300,000. Now, there are 470 shares of the stock, out of which Olivia (represented by "OH") acquired 70 shares two years ago by transferring property worth $660,000 that had a basis of $110,000. As of January 1st of the current year, Cerulean Corporation has accumulated E&P of $350,000. On March 1st of the current year, the corporation distributed property worth $120,000 to E, with a basis to the corporation of $50,000. Additionally, it distributed cash of $220,000 to Olivia on July 1st of the current year. Olivia also sold her stock to Magnus for $820,000. Then, on December 1st, Cerulean Corporation distributed cash of $90,000 each to Magnus and Tui. Now, the question is, what are the tax issues involved in this scenario? There are seven tax issues that we could consider. Let's go through them. The first tax issue is: What basis do II and O have in their stock and Cerulean Corporation after their initial transfer for stock? This is the first tax issue. The second tax issue is: Does Olivia's transfer qualify under section 351 of the code as a non-taxable exchange? The third tax issue is: How is Cerulean Corporation taxed on the property distributed to E? The fourth tax issue is: How do the distributions to E in 2020 affect Cerulean's A and P? The fifth tax issue is: How will I and O be taxed on the distributions? The sixth tax issue arises from this scenario and involves the question: What is Olivia's basis in her stock when she sells it to Magnus? As you can see, this is fairly complex. Lastly, the final tax...

Award-winning PDF software

Video instructions and help with filling out and completing Can Form 1120 Schedule M 3 Reorganization