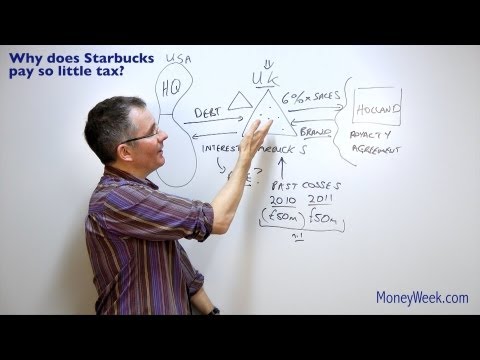

Music Applause Music. - How do they do it? Several companies have been in the news recently, Starbucks and eBay, and all for the same reason. And it's not one they want to be in the news for - paying very little tax. - Let's take a look at that topic in this video and ask the question: How is it that according to Reuters, Starbucks has only paid around eight and a half million dollars in tax over the last few years when it's made billions of dollars in sales of coffee and the like? - Similar accusations have been made towards eBay and one or two other companies. - So how do they do it? Well, we're going to get to that in just a moment. I'm going to reveal three little tricks that companies like that in the retail sector can employ to minimize their tax bills. - Now, before I set off, let me just say one thing: none of those companies have been accused of doing anything illegal. Avoiding tax is all about negotiating, using expensive accountants and lawyers with HMRC, the tax authorities in this country, and reducing the amount of tax you pay. - The name of the game, if you want to pay a little bit of tax, is to declare low profits. So, if you're talking to investors and there's a company you want nice big profits for, doing incredibly well. But if you're talking to the tax authorities, you put your dour face on and say, "Oh, no, we don't make any money." - Because if you're not making any money, they can't charge you any tax. - Okay, so the name of the game is reducing profits to avoid paying more tax. - So, first thing is, we're not...

Award-winning PDF software

Video instructions and help with filling out and completing Can Form 1120 Schedule M 3 Consolidating