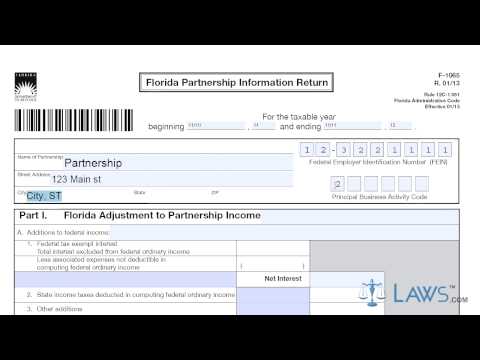

Laws.com legal forms guide Form F-1065 is the Florida partnership information return. Florida partnerships with partners subject to the state corporate income tax are required to file this form. The same requirement applies to limited liability companies with a corporate partner classified as a partnership for federal tax purposes. You can find this form on the website of the Florida Department of Revenue. Here are the steps to correctly fill out Form F-1065: 1. Provide the beginning and ending dates of your taxable year at the top of the form. 2. Enter the partnership's name, address, federal employer identification number, and principal business activity code. 3. In Part 1, document Florida adjustments to partnership income. Calculate your net interest on line 1. Enter state income taxes deducted in computing federal ordinary income on line 2. Enter other additions on line 3 and enter the total on line A. 4. Give subtractions from federal income on line B. Subtract line B from line A and enter the difference on line C. Enter the net adjustments from other partnerships or joint ventures on line D. Give the total of lines C and D on line E. 5. In Part 2, document the distribution of partnership income adjustments. In the first column, give each partner's name and federal employer identification number. 6. In column A, enter the amount from line E above. Note that if there are no adjustments on line E, only complete column B and leave the other two blank. 7. In column B, give the partners' percentage of profits. 8. Multiply column A by column B and enter the resulting product in column C. 9. A partner or member should sign and date the bottom of the first page. If a paid preparer has completed the form, they should give...

Award-winning PDF software

Video instructions and help with filling out and completing Can Form 1120 Schedule M 3 Charitable