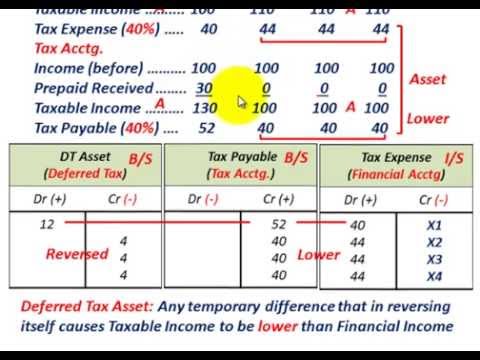

What we're going to be going over here is just a basic understanding of what tax liability is and also what a deferred tax asset is. Let's start out with a deferred tax liability. By definition, what it means is any temporary difference that, in reversing itself, causes taxable income to be higher than financial or book income. We're going to be looking at an example here to understand the calculations and differences between financial accounting and tax accounting using depreciation expense. 2. In financial accounting, it is commonly referred to as book accounting basis, while tax accounting and financial accounting can have differences when determining taxable amounts. Let's look at the depreciation expense as an example of how it becomes a deferred tax liability. 3. For our example, let's assume we have an income of $200,000 per year for four years and a constant depreciation expense of $25,000 for each of those years. The difference between our income before the expense and the depreciation expense gives us a taxable income of $175,000 for each year. 4. Considering a tax expense of 40% on the taxable income, we would have a tax expense of $70,000 for each year. 5. Now, let's examine the tax accounting and the differences. In this case, we were able to use accelerated depreciation, resulting in higher depreciation expenses for tax accounting compared to financial accounting. For the first year, the depreciation expense for tax accounting is $33,000. For the second year, it is $44,000. For the third year, it is $15,000. And for the fourth year, it is $8,000. 6. As a result, our taxable income for tax accounting is $167,000 for the first year, $156,000 for the second year, $185,000 for the third year, and $192,000 for the fourth year. 7. Using the same tax expense calculation of 40% on...

Award-winning PDF software

Video instructions and help with filling out and completing Are Form 1120 Schedule M 3 Subsidiary