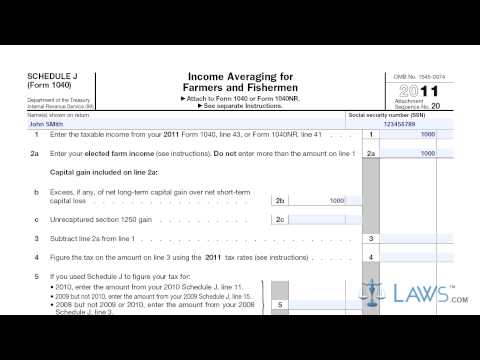

Laws.com legal forms guide income averaging for farmers and fishermen. 2. Schedule J, step one: A farming business qualifies as the following: - Operating a nursery or sod farm - Raising or harvesting of trees bearing fruits, nuts, or other crops - Raising ornamental trees - Raising, shearing, feeding, caring for, training, and managing animals - Leasing land to a tenant engaged in a farming business, but only if lease payments are based on the share of the tenant's production or determined under a written agreement. 3. A fishing business qualifies as the following: - Catching, taking, or harvesting of fish - Attempted catching, taking, or harvesting - Operations at sea in support of the activities listed above - Leasing of a fishing vessel, but only if payments are based on a share of the catch or determined under a written lease before the lease begins. - Compensation as a crew member on a vessel in a fishing business, but only if compensation is based on a share of the catch. 4. The IRS provides specific instructions for this format. Please refer to the following link: [provide link]. 5. Step 2: On line 1, provide the taxable income from your 2011 Form 1040, line 43, or Form I 40, and our line 41. 6. Step 3: For lines 2a through 5, refer to pages J2 and J-3 on the instructions provided by the IRS. 7. Step 4: For line 6, divide the amount on line 2a by 3.0. 8. Step 5: Combine the totals on lines 5 and 6. If the amount is zero or less, enter zero. For specific instructions on line 8, refer to pages J4 through J6 on the instructions provided by the IRS. 9. Step 6: Refer to the instructions from the IRS on page J7 for line 9. 10. Step 7: For line...

Award-winning PDF software

Video instructions and help with filling out and completing Are Form 1120 Schedule M 3 Revenue