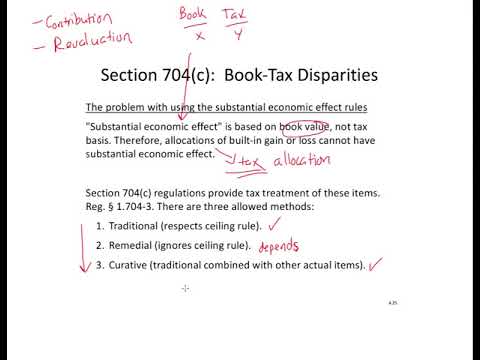

Hello, in this video we'll cover the third part of the allocation series, a three-part series. Specifically, in part three, we're talking about allocations related to book-tax disparities. Now, if you have not viewed the first two parts of the allocation series, please watch those, especially the first part. So, if you recall, we're talking about allocations, not distributions, with respect to partnerships. We're discussing the tax consequences of allocations. Allocations determine how items of income, gain, deduction, loss, credit, and so on are allocated among or between the partners. Under Section 704 of the Internal Revenue Code, which we refer to as the IRC, the general rule is that we will respect whatever the partnership agreement states regarding allocations. However, under Section 704(b) of the IRC, the allocation will be respected only if it has a substantial economic effect. Now, what exactly does substantial economic effect mean? We discussed this in part one of the video. Please recall that there are certain special situations specifically related to non-recourse deductions and book-tax disparities. In this video, we will cover the book-tax disparities. The idea is that if you are allocated a dollar with respect to taxes, then on paper, economically, you should also be gaining that dollar. In partnership tax, we do a lot of recording of capital accounts, book accounts, tax numbers, and tax bases. The book allocation must equal the tax allocation. That's the key to economics. In part two of the video, we discussed non-recourse deductions. However, I won't discuss non-recourse deductions in this video because it is not related to the topic. I will explain how part one ties to part three. This is when a partner contributes property to the partnership, whether upon formation or later on, and there is a disparity. There is almost always a...

Award-winning PDF software

Video instructions and help with filling out and completing Are Form 1120 Schedule M 3 Reorganization