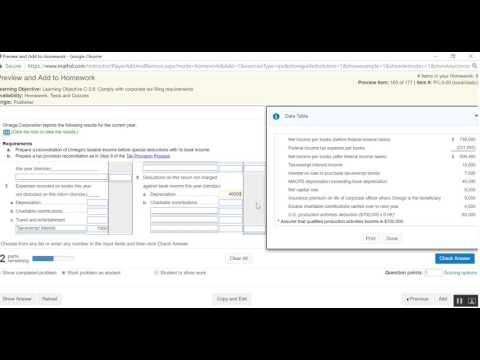

Hi everyone, I'm going to walk you through problem three-dash 59, which I've assigned to you. I like this problem because it walks you through the process of doing a reconciliation of book income to taxable income on Schedule M1 of Form 1120, which you guys will need to do when you fill out your 1124 me later in the semester. In another couple of weeks, you'll be doing that. It also walks you through how to do a tax provision reconciliation, which essentially is the same thing, but you slice and dice the reconciliation a little bit differently. You still start with book income and end with taxable income. When you go into public accounting, whether you're on the audit side or the tax side, you're going to see tax provisions likely, and you're going to be involved with either preparing or reviewing a tax provision someday. So, this is a really practical exercise. First of all, we start with the first requirement, which is to prepare a reconciliation of taxable income to book income to taxable income using Schedule M1. To do that, here's what a Schedule M1 looks like on the tax return Form 1120. It tells us to enter net income or loss per book. So, our net income per the data table is $730,800. Then, we enter our federal income tax expense per books of $231,540. Oh, sorry, this is wrong. I actually want to enter my net income per books after federal taxes of $506,460 because then what this schedule is going to have me do is add back the federal income taxes. Because if you look on pages 39 and 40 of your book, there's a really nice set of book-tax differences listed. Book-tax differences are differences that are items that are different for book...

Award-winning PDF software

Video instructions and help with filling out and completing Are Form 1120 Schedule M 3 Reconcile