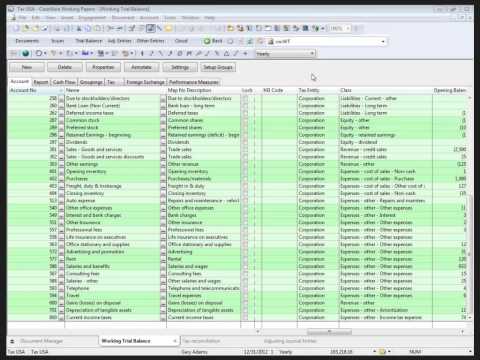

Now, I've got a couple more questions here and more rolling in. We're going to go a little bit long today. I hope that's okay for everyone. We have a question. It says we have historically used grouping report in lieu of tax reconciliation. Now we see what the tax reconciliation working paper can do and I expect we'll switch to using that. Is there a document suggestion for tax provisions as well? We typically use an excel file. For your tax provisions, you would be looking at your net income and your reconciliation to tax income. So, if I were to go to my tax reconciliation document, I would be able to work out what my taxable income is expected to be here. Now, keep in mind, this is just the balance sheet and income statement information. There may be other mitigating factors that you will have to enter into your tax software to determine the true taxable income for tax purposes. However, if you just want to estimate and you want to use your adjusted tax income balance, what you can do is I would suggest using an Excel document or a case view document that takes that number, and you can apply calculations based on the tax rates in your locale. That would likely be the best way to manage that for your tax provision.

Award-winning PDF software

Video instructions and help with filling out and completing Are Form 1120 Schedule M 3 Prepares