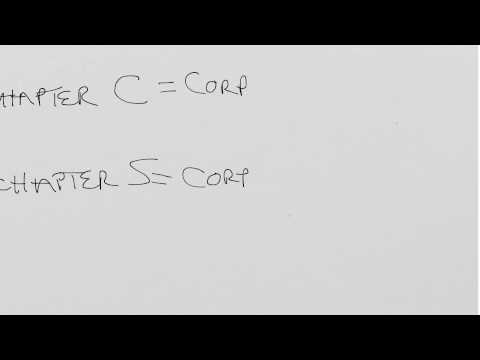

Okay, I think we had a good opening class today. But, I just wanted to hone in on a couple of points to make sure they're clear. Then, maybe otherwise came out in class. And of course, I'm hoping that you will learn this information from reading chapter 15 as well. The idea is that there are business entities that earn income. And just like an individual pays income tax on income earned, the tax code says income earned by a business entity should also be taxed. So, it came about that the tax code identified certain organizations as being business entities. And they were primarily corporations, partnerships, and as we saw, a different form of the business entity, where since they person partnerships were really to sole proprietorships. One here, let's say, and one here. So, they'll be taxed at this level rather than the entity level. For corporations, the tax is at the entity level. The corporation pays the tax. Here, it's the individuals pay the tax earned based on their share of the profits. We mentioned in class corporations, and we also mentioned C Corp & S corp. We'll talk more about these on Wednesday, but for now, I want to make sure you are following. Is that these are both statutory corporations chartered by the states. They are both just plainly from a charter standpoint, corporations. As far as the charters of the states, there is no such thing as a c-corp charter or an s-corp charter. It's just plainly a corporation. What happens is that under the tax code, there is a subchapter. If you were to look at the outline, and I encourage you to look at the outline of the Internal Revenue Cutter to get a feel for this, there's a subchapter C...

Award-winning PDF software

Video instructions and help with filling out and completing Are Form 1120 Schedule M 3 Indirectly