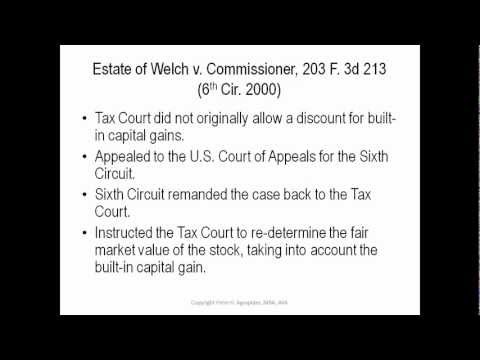

Divide this text into sentences and correct mistakes: Hello, this is Peter, a burpee DS, and I'm with Western Valuation Advisors. We have offices in Salt Lake City, Las Vegas, Nevada, and I'm going to be presenting today for the quick tip of the week. The subject that we're going to cover today is built-in capital gains. The way that I want to present this to everybody today is to go over a series of case law that actually begins in 1935 and goes up through almost our current date. That everybody is watching this today, this area of case law is very interesting to me for two reasons. For one reason, it presents very linearly how this train of thought to adjust for built-in capital gains tax has evolved from 1935. And secondly, since it is such a linear progression of case law, something that really makes it easy for us to go and make the adjustment for built-in capital gains tax. One thing that I do want to talk about here at the beginning, and I will probably recap this at the end of the presentation also, is the fact that a lot of people refer to this as a discount for built-in capital gains tax. But here at the beginning, I want everybody to get into the frame of reference of looking at this as an adjustment for built-in capital gains tax. It's something that you can quantify numerically. You can look at a C-corporation. You can look at the appreciation, the value of assets, and you can determine the exact amount that that a tax built-in capital gains tax would be due on the date of your valuation. Okay, so we'll talk about that a little bit more as we get into talking about the actual adjustment....

Award-winning PDF software

Video instructions and help with filling out and completing Are Form 1120 Schedule M 3 Historical