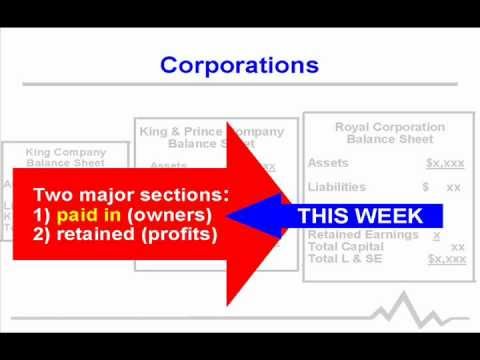

Hey, thanks for this opportunity. We can talk a little bit about the next topic, which is corporations. You bring some common knowledge into the class. I bet you've heard of corporations and know a little bit about them. You've shopped there, maybe you've had a part-time job there, or maybe your family works or owns one. You hear about the number of shares traded on the stock exchange bought and sold every day if you listen to the nightly news. It's a topic you know something about. From an accounting perspective, it's also a topic you know a little bit about and we can relate it to prior knowledge. Let's talk about the overview and some of the things we're going to cover and be held responsible for. We'd like to know about corporations and how they're different from proprietorships or partnerships, which we've covered in the past. Obviously, there are some similarities and there are some differences, some major differences. When we have an owner invest in the business, we give them a share of stock. Initially, we should be curious about what rights that share of stock possesses. We ought to talk about it today. And sometimes, there's more than one class of stock. We call it common stock and preferred stock. Students are generally curious about the differences between those two. What makes a share of stock preferred? Let's talk about some of the rights that we would expect a share of preferred stock to have. One of the major objectives is how do we go about issuing stock? When owners invest in the business, our response is to give them shares of stock to represent their ownership claim on the business. We should talk about the journal entries that would be expected of us from the corporation's point...

Award-winning PDF software

Video instructions and help with filling out and completing Are Form 1120 Schedule M 3 Entries