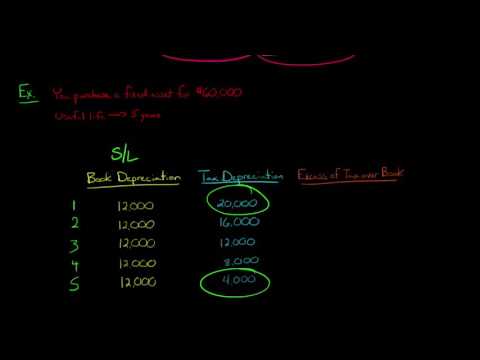

In this video, we're going to discuss the temporary and permanent differences between book income and taxable income. It's important to remember that book income and taxable income are not the same thing in the United States. Book income refers to income reported from your income statement for financial reporting purposes, while taxable income is reported to the IRS for determining the corporation's tax obligations. These differences have different objectives and are calculated in different ways. Temporary differences between book income and taxable income can occur if they will reverse in a future period, resulting in the same amount of deductions. It's just a timing difference. On the other hand, permanent differences occur when there's never going to be a reversal. For example, income from life insurance proceeds is never taxable but is part of book income. Let's take an example to illustrate the difference between temporary and permanent differences in taxes. Suppose we purchase a fixed asset for $60,000 with an estimated useful life of five years. For book purposes, we depreciate the asset evenly over the five years, resulting in $12,000 of depreciation each year. However, for tax purposes, depreciation is accelerated. In the first year, $20,000 is deducted, which decreases over time and reaches $4,000 in the final year. If we compare the tax deductions to book deductions, in year one, there's an excess tax deduction of $8,000. In year two, it's $4,000, and in year three, there's no difference. In year four, book deductions exceed tax deductions, and in year five, there's an excess tax deduction of $8,000. When we add up these differences, we find that the total is zero. This signifies a temporary tax difference because it reverses over time. It's referred to as a deferred tax liability. In contrast, a permanent tax difference never reverses. For example,...

Award-winning PDF software

Video instructions and help with filling out and completing Are Form 1120 Schedule M 3 Deductible