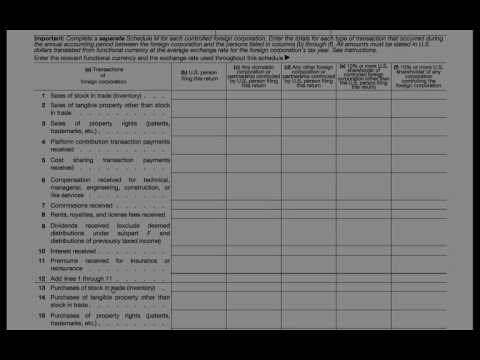

P>Form 50 471 Schedule M reports transactions between a controlled foreign corporation and certain related persons. Schedule M is required to be included with form 54 71 if the person is filing as a category 4 filer. Generally, a category 4 filer is a U.S. person who had control of the foreign corporation for at least 30 days during the year. Schedule M is completed in U.S. dollars, and the exchange rate is entered here. Lines 1 through 11 show income items, lines 13 through 23 show expense items, and lines 25 and 26 show intercompany loans. Sometimes people get confused as to whose income or expense items are being referred to in the first column for incorporation or the other persons listed. The way that I remember it is to start here by saying, "Did the foreign corporation sell inventory?" If the foreign corporation sold inventory, who did it sell the inventory to? Did it sell the inventory to the U.S. person filing this return, to a related domestic corporation, to a related foreign corporation, etc. So, why does the IRS want this information about related party transactions? There are multiple reasons. First, if there are related party transactions, the IRS may want to investigate further to confirm that the transfer pricing rules are being complied with and that transactions are on an arm's length basis. Second, certain related party transactions can trigger subpart F income. For example, if a foreign corporation sold inventory to a related party, the gain on that sale of inventory may be foreign base company sales income, a type of subpart F income. Similarly, if the foreign corporation receives services income, that income can be foreign based company services income, another type of subpart F income. Also, the receipt of dividends, interest, rents, and royalties can all be...

Award-winning PDF software

Video instructions and help with filling out and completing Are Form 1120 Schedule M 3 Columns